[ad_1]

IDBI Bank Credit Card Statement 2023: Download IDBI Credit Card Application, Eligibility Criteria and IDBI Credit Card Statement PDF Online at https://idbibank.in

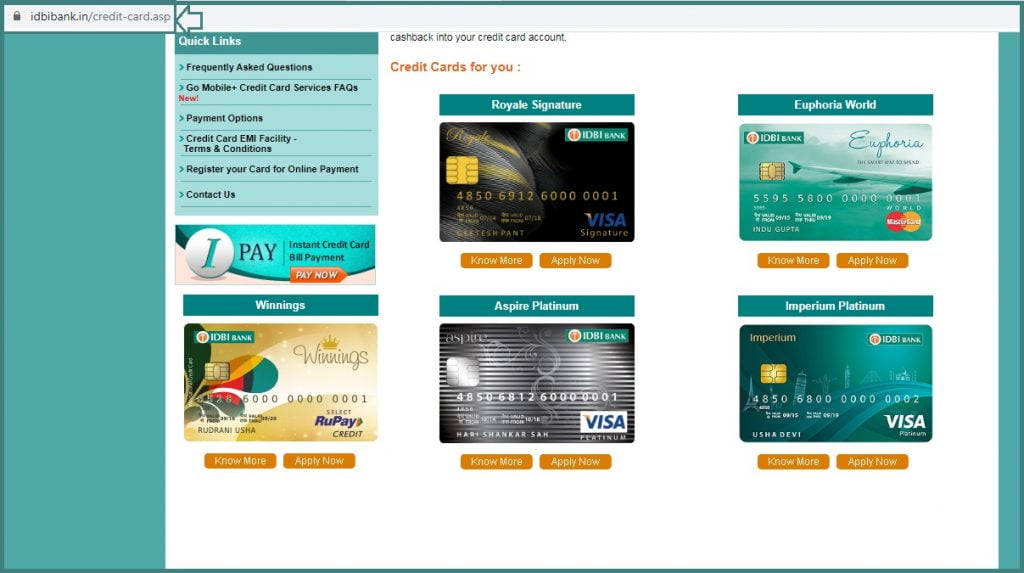

IDBI Bank Credit Card

IDBI Bank understands the spending habits of all their registered customers. And thus presents a credit card that suits their needs. IDBI offers a wide range of credit card categories. Each is associated with different benefits. Customers can choose the card according to their preference. This card helps save money through category-based offers and rewards.

IDBI Credit Card Categories

- Travelcard

- Shopping card

- Reward card

- Free card for life

- Business card

- Lifestyle Card

- Business card

- Entertainment card

- Cashback Card

Eligibility Criteria

To avail the credit card benefits, the user must fulfill the criteria set by IDBI Bank.

The bank allows applicants in the age limit of 21-65 years and add-ons cardholder should be 18 years. Any person below or past the said age is not eligible for credit card.

To request an IDBI Bank Card, the applicant must have a regular income. However, the income criteria will be different according to the choice of credit card. While applying for a credit card, the customer must provide income proof documents.

Applicant must be a resident of India.

Idbibank.in/credit-card.aspx

How to Apply IDBI Credit Card for New Customers

- Open the IDBI Bank website page to access the credit card page.

- https://www.idbibank.in/credit-card.aspx

- On the IDBI page, enter your personal and contact details.

- Enter or upload your KYC documents on the page.

- The system will verify the details and a bank representative will contact you.

- A representative will guide you through the next steps.

- You will receive an Application ID or Reference Number.

- Applicants can also visit the bank for credit card application.

Necessary documents

- Address proof documents like Passport, DL, Voter ID and more.

- Identity proof documents

- Income proof

- PAN card

- A recent passport size photograph.

IDBI Bank Credit Card Statement

How to Check IDBI Credit Card Statement

IDBI credit cardholders can check their card statements through the online platform. The statement will contain details like address, account number, registered mobile number and name. The card statement will show the available charges and total balance on your IDBI credit card.

How to Check IDBI Credit Card Statement Using IDBI Net Banking

- Visit the IDBI website page and log in to the IDBI Credit Card Net Banking account page.

- https://inet.idbibank.co.in

- On the menu, click on the “Credit Cards” option.

- Next, click on the “Credit Card Statement” option.

- Select the period (month or year) for which you want to view the statement.

- The system will display the statement details on your screen.

IDBI Bank credit card Statement Check through IDBI Mobile Banking

- On your smartphone, download the IDBI mPassbook app.

- After installation, enter your mobile number and customer ID.

- Enter the OTP number sent to your mobile number to verify the details.

- Select the “Continue” option, the system will request you to set your PIN.

- A PIN helps you access the app.

- Proceed to the “Credit Cards” tab and then the “Statement” option.

- Select the time frame for which you need the statement.

- The system will generate the statement and display it on your screen.

FAQs

- Can I verify my e-statement through offline methods?

Yes, IDBI Bank has a customer care toll-free number 022-40426013 or 18004257600. You can also give a missed call on 18008431133. The call will ring a few times and automatically disconnect. Bank will send mini statement through SMS method.

- IDBI Credit Card Customer Care Number

1800-209-4324 and +9122-67719100 (chargeable)